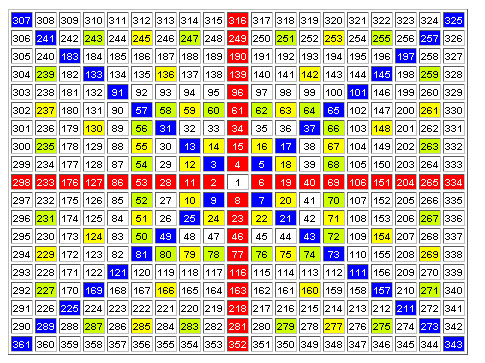

Gann Square Of 9 Calculator Excel

How to trade with the Gann Square of 9 is something that continues to intrigue many WD Gann students. Being able to properly understand how the Square of 9 works requires the student to have a base level of knowledge about Gann theory. You simply will not be able to understand the Square of 9 unless you have a solid understanding of WD Gann's primary trading methods.Learning how to master the Square of 9 can take students years. That was certainly the case for me. And whilst a number of courses out there claim to de-mystify the 'hidden secrets' to the Square of 9, I have not yet come across anyone who has been able to explain how to use it, simply, consistently and profitably in the markets.Until now. Let me show you.There are a number of free articles out there on the internet which describe how to construct a Gann Square of 9 chart, and they will explain that it is a mathematical square root calculator devised from ancient mathematics - so I won't attempt to bore you by repeating that detail here in this post.What most people won't tell you however is that all financial markets, whether they are forex, stock indices or commodity markets work to the harmonics of the Square of 9 in different manners. Each market displays its own unqiue behviour to the Square of 9 Calculator, which I will demonstrate below.Learn more about the timing methods of WD Gann by visiting our, today!The S&P 500 index for example works to the harmonics of the 225 degree angle in the Square of 9 incredibly well.

Gann SQUARE of 9 Calculator NIFTY BANKNIFTY INTRADAY Levels Gann Calculator. INTRADAY Levels Gann Calculator. FATAFAT NIFTY LEVELS. TRADE OR NO TRADE; PIVOT POINTS; GANN SQ 9; F&O LOT SIZE; RESULTS CALENDER; SIP CROREPATI TABLE; LIVE CHARTS; SGX NIFTY; Gann SQ 9 values from Yesterday Close. GANN for 30 Apr S 4 S 3 S 2 S 1 YEST CLOSE R.

I have highlighted this 225 degree in the Square of 9 chart below.The next chart shows you the calculations of the Gann Square of Nine Calculator using the 225 degree angle, and how this has consistently, simply and practically provided significant price resistance and support on the S&P500 index over the last 5 years. For example, the very recent double bottoms of 1804 and 1805 on the S&P500 occurred almost exactly on this 225 degree angle - the actual Square of 9 price was 1807. In a previous blog, I outlined (in writing) to friends and colleagues ahead of time, why I thought the price level of 1806 was going to act as significant support for the S&P500 index. The index has rallied over 10% since. Wwe 13 pc download highly compressed. You can read that blog.Knowing which angle on the Square of 9 to use on your chosen market therefore takes on an increased importance, particularly when you are trying to use it to identify practical trading opportunities.

Active Angles on the Square of 9 are just one way of practically using it to effect. Another way to use the Square of 9 is to help you identify intraday price levels as well as turning points, which (believe it or not) can be calculated precisely to the exact minute. But we can leave that discussion for another blog at another time.If you are however interested in learning more about the Square of Nine, please feel free to email us at: This email address is being protected from spambots. You need JavaScript enabled to view it. And we would be glad to see how we can help.Until next time.

In volume 1 of this master course you will discover the best kept secrets to determine the likely prices of future market tops and bottoms, years in advance. This is all about teaching you 'where' is the best price to buy or sell.Beautifully presented in over one hundreds pages of easy to follow descriptions and coloured charts, you will be privy to some of the most powerful price forecasting techniques in the markets. Real life and up to date examples covering the S&P 500 stock index are used to explain how these price techniques work across any market. Learn how to incorporate these price techniques into your trading, today!We are so certain that these techniques will work in any liquid market, that we will gladly provide a 100% Money Back Guarantee if they don't.TOPICS COVERED INCLUDETRADING WITH THE TREND. How the mathematical and geometric relationships work in the market. An introduction to W.D. In volume 1 of this master course you will discover the best kept secrets to determine the likely prices of future market tops and bottoms, years in advance.

This is all about teaching you 'where' is the best price to buy or sell.Beautifully presented in over one hundreds pages of easy to follow descriptions and coloured charts, you will be privy to some of the most powerful price forecasting techniques in the markets. Real life and up to date examples covering the S&P 500 stock index are used to explain how these price techniques work across any market. Learn how to incorporate these price techniques into your trading, today!We are so certain that these techniques will work in any liquid market, that we will gladly provide a 100% Money Back Guarantee if they don't.TOPICS COVERED INCLUDETRADING WITH THE TREND.

How the mathematical and geometric relationships work in the market. An introduction to W.D. Volume 2 of this course will absolutely blow your mind. Learn how to “time” a market and the techniques that can forecast bull market highs and bear market lows to the exact day.

Time Factor Trade ReportThe Time Factor Trade Report looks at the financial markets in a way you have never looked at them before. Find out why the Dow Jones is headed to 30,000 by subscribing, now! Your subscription will entitle you to receive the monthly report as well as exclusive regular updates on the United States, Australian and Indian equity markets as well as Gold, Precious Metals and currencies. We use our own proprietary indicators to identify the major time cycles dictating when stocks and commodities are likely to go higher or lower.Download your free sample by clicking.